What is the ROI of a Rental Property in Panama in 2024?

The Return on Investment (ROI) for rental properties in Panama in 2024 can vary significantly depending on location, property type, rental strategy, and other factors. However, many investors may find Panama’s rental market to be stable and possibly profitable due to the country’s popularity with expats, retirees, and tourists.

What is a Return on Investment in real estate?

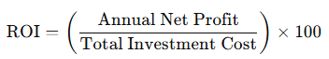

Return on Investment (ROI) in real estate is a metric that indicates the profitability of a property investment relative to its cost. In real estate, ROI is generally expressed as a percentage and is calculated by comparing the annual rental income or profit to the initial investment cost. Here’s a breakdown of ROI in real estate.

The Formula:

- Annual Net Profit: This is the income from the property after expenses like property taxes, maintenance, property management fees, insurance, and loan interest have been deducted.

- Total Investment Cost: The initial costs of acquiring the property, including the purchase price, closing costs, renovation costs, and any other upfront expenses.

Example: if you have a rental property generating $20,000 per year in net profit and you invested $200,000 to acquire and renovate it, the ROI would be 10%: (20.000 divided by 200.000, and multiplied by 100%).

While it is important to state that we are not financial specialists and do not offer any financial advice in the following information. Below is an overview of what the return on investment might look like and the key factors influencing it in 2024, based on the data shown in real estate websites such as encuentra24.com, comprieoalquile and other real estate classifieds:

1. ROI Ranges in Popular Areas

Panama City: Panama City typically offers a rental yield between 5% to 8%, depending on the neighborhood and property type. Luxury condos in areas like Punta Pacifica or Costa del Este may offer slightly lower yields due to higher purchase prices, but they can provide stable, long-term rental income from business professionals and expatriates.

Beachfront Areas (e.g., Coronado, Playa Blanca): These areas see high demand for short-term rentals, especially in peak tourist season, with ROI typically ranging from 7% to 10% for vacation rentals. Beachfront properties in these areas benefit from high occupancy rates during tourist seasons, though income can fluctuate seasonally.

Mountain and Highland Regions (e.g., Boquete): Popular among retirees and long-term expats, mountain towns like Boquete can yield around 5% to 9%. While these properties may not see as much short-term rental demand as beachfront or urban properties, they often attract longer-term tenants, providing a more stable rental income.

2. Short-Term vs. Long-Term Rentals

Short-Term Rentals: Properties listed on platforms like Airbnb in tourist-heavy areas (like in beaches or in Panama City) can achieve higher ROI, especially during high season. Short-term rentals require more management and marketing but can yield ROI in the range of 8% to 12% due to premium nightly rates.

Long-Term Rentals: Long-term rentals often yield a steadier ROI, typically between 5% and 8%. This strategy involves lower turnover costs and less maintenance but generally results in a lower per-night rate compared to short-term rentals.

3. Key Factors Affecting ROI in Panama

Occupancy Rates: In popular areas, occupancy rates are generally high due to strong demand from expats and tourists, which positively impacts ROI. Beachfront and mountain properties might see fluctuations seasonally, but Panama City properties often have consistent occupancy year-round.

Property Taxes and Maintenance: Panama offers tax incentives, including property tax exemptions on new constructions for up to 20 years. This can significantly improve ROI, though investors should still factor in maintenance costs, especially in coastal areas where humidity can increase upkeep needs.

4. Economic and Market Factors

Panama’s growing economy, stable dollarized currency, and favorable residency options for foreign investors all contribute positively to the real estate market. Panama’s popularity as a retirement destination and tourist hub continues to grow, supporting steady rental demand and helping maintain ROI levels even amid broader economic shifts.

Conclusion

In 2024, ROI for rental properties in Panama remains promising, with many areas seeing yields between 5% and 10%. Choosing the right property type, rental strategy, and location can significantly impact ROI, making Panama an attractive option for both short-term and long-term rental investors.